Financial Statement Analysis Involves Forms of Comparison Including:

A short summary of this paper. Types of Financial Analysis.

Financial Statement Analysis Principles Of Accounting Volume 1 Financial Accounting

Companys accounting reports financial statements in order to gauge its past present or.

. C Comparing changes in the same item over a number of periods. Financial statement analysis involves forms of comparison including. A Comparing key items to industry averages.

Ability to calculate compare and interpret these financial ratios is a key learning objective of this chapter. The ratios are used to identify trends over time for one company or to compare two or more companies at one point in time. Comparing changes in the same item over a number of periods.

Financial statement analysis is the process of analyzing a companys financial statements for decision-making purposes. Financial statement analysis involves forms of comparison including. Comparing changes in the same item over a number of periods.

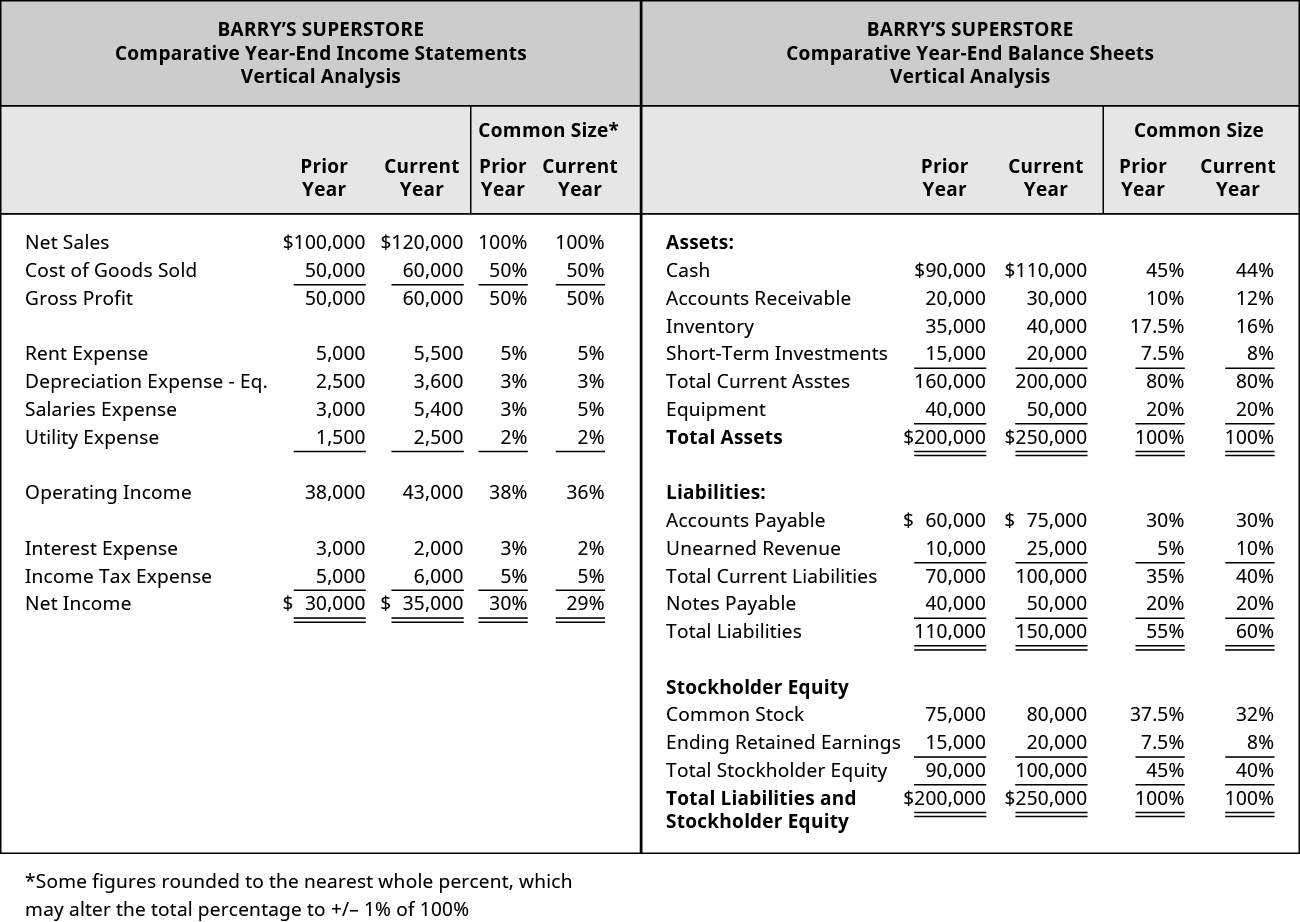

FINANCIAL ANALYSIS AND BUSINESS VALUATION. Financial statement analysis involves forms of comparison including. Vertical Analysis Select the correct statements regarding vertical analysis.

Financial Analysis Type 1. Learn more in CFIs Financial Analysis Fundamentals Course. Financial statement analysis involves forms of comparison including.

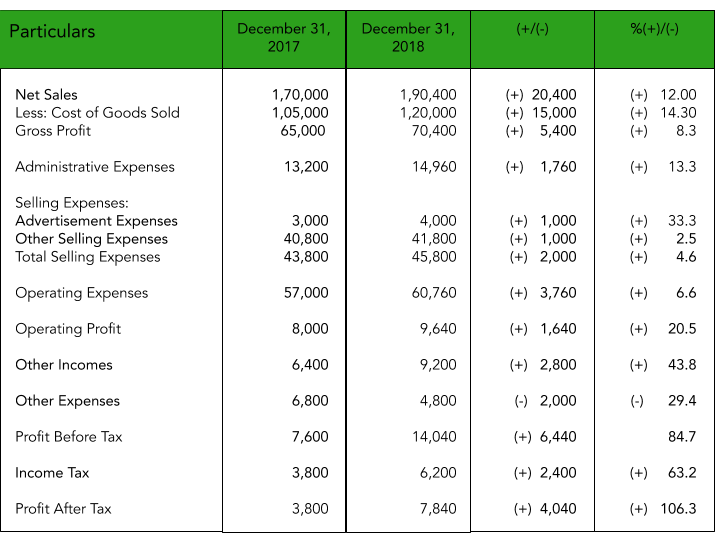

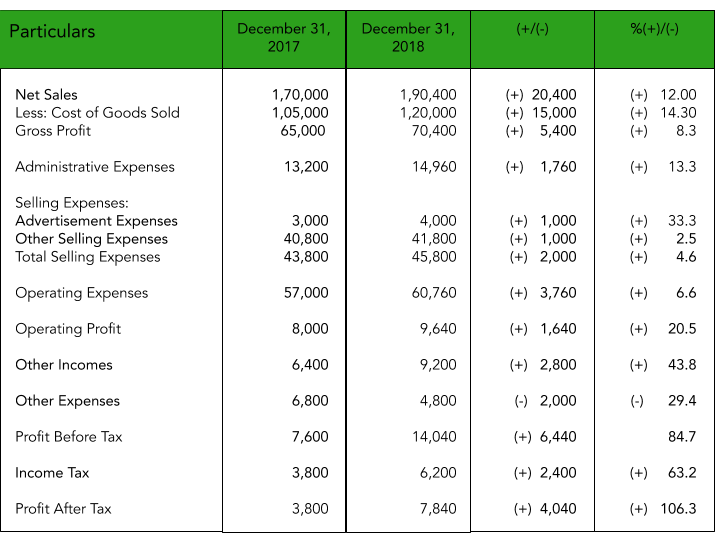

B Comparing key relationships within the same year. According to material used financial analysis can be of two types. Horizontal analysis of financial statements involves comparison of a financial ratio a benchmark or a line item over a number of accounting periods.

The most common types of financial analysis are. Comparing key relationships within the same year. All of these answers are correct.

D All of these answers are correct. Comparing key relationships within the same year. B comparing key relationships within the same year.

Horizontal analysis is the comparison of financial information over a series of reporting periods while vertical analysis is the proportional analysis of a financial statement where each line item on a financial statement is listed as a percentage of another item. Comparing changes in the same item over a number of periods. Vertical analysis also known as common-size analysis is a popular method of financial statement analysis that shows each item on a statement as a percentage of a base figure within the statement.

A comparing changes in the same item over a number of periods. Financial Statement Analysis is a method of reviewing a nd analyzing a. FINANCIAL ANALYSIS AND BUSINESS VALUATION.

The first method is the use of horizontal and vertical analysis. An analysis procedure that uses percentages to compare each of the parts of an individual statement to a key dollar amount from the financial statements is. Financial health is one of the best indicators of your businesss potential for long-term growth.

To conduct a vertical analysis of balance sheet the total of assets and the total of liabilities and stockholders equity are generally used as base figures. It also indicates the behavior of revenues expenses and other line. External stakeholders use it.

Comparing changes in the same item over a number of periods. A proper analysis consists of five key areas each containing its own set of data points and ratios. The first step toward improving financial literacy is to conduct a financial analysis of your business.

Liquidity profitability and solvency. Comparing key relationships within the same year. On the Basis of Material Used.

Financial statement analysis involves forms of comparison including. The intent is to discern any spikes or declines in the data that could be used as the basis for a more detailed examination of financial results. Ratio analysis is used to evaluate relationships among financial statement items.

An evaluation of one process or activity across several groups or departments within an enterprise. Financial statement analysis involves forms of comparison including. Comparing key relationships within the same year.

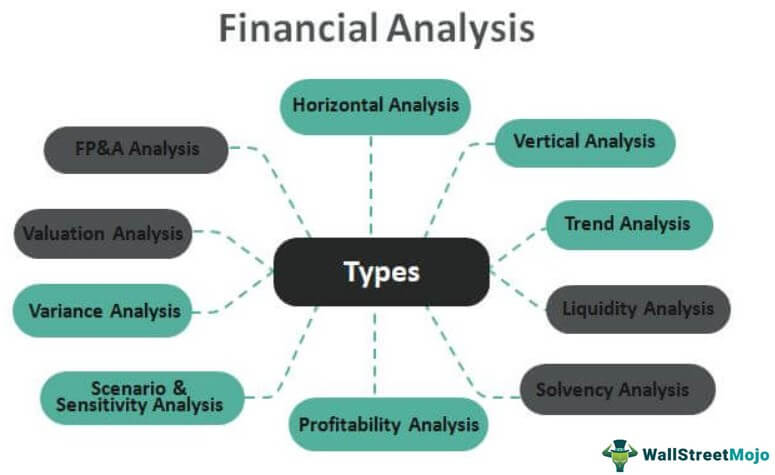

This guide will cover the most common types of financial analysis performed by professionals. Horizontal analysis allows the assessment of relative changes in different items over time. The following points highlight the four important types of financial analysis ie 1 On the Basis of Material Used and 2 On the Basis of Modus Operandi 3 On the Basis of Entities Involved and 4 On the Basis of Time Horizon or Objective of Analysis.

All of these answers are correct. Financial statement analysis is one of the most important steps in gaining an understanding of the historical current and potential profitability of a company. Comparing key items to industry averages.

A horizontal audit is appropriate for. Financial statement ratio analysis focuses on three key aspects of a business. Financial analysis is also critical in evaluating.

37 Full PDFs related to this paper. Comparing key items to industry averages. Full PDF Package Download Full PDF Package.

Comparing key items to industry averages. This method of analysis is also known as trend analysis. This involves the side-by-side comparison of the financial results of an organization for a number of consecutive reporting periods.

Types Of Financial Analysis List Of Top 10 Financial Analysis

Comparative Statements Analysis Of Balance Sheet Income Quickbooks

Financial Statement Analysis Principles Of Accounting Volume 1 Financial Accounting

Comments

Post a Comment